capital gains tax proposal

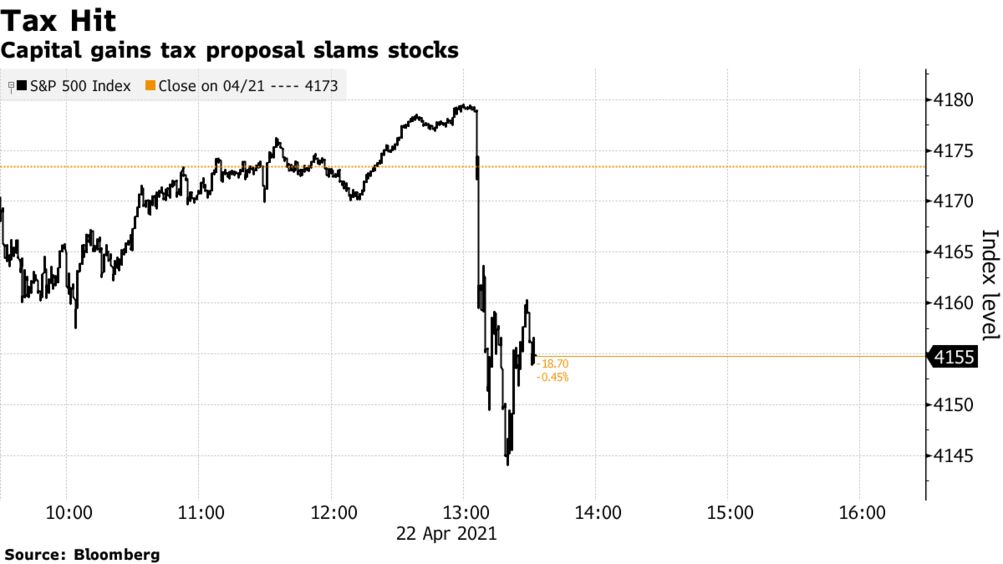

The top capital gains rate would nearly double to 396 from 20 currently and the additional 38 Medicare surtax that currently applies would bring the highest capital gains. The top marginal income tax bracket.

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

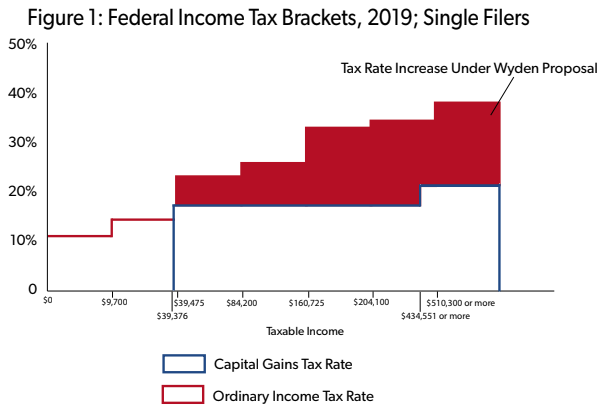

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital.

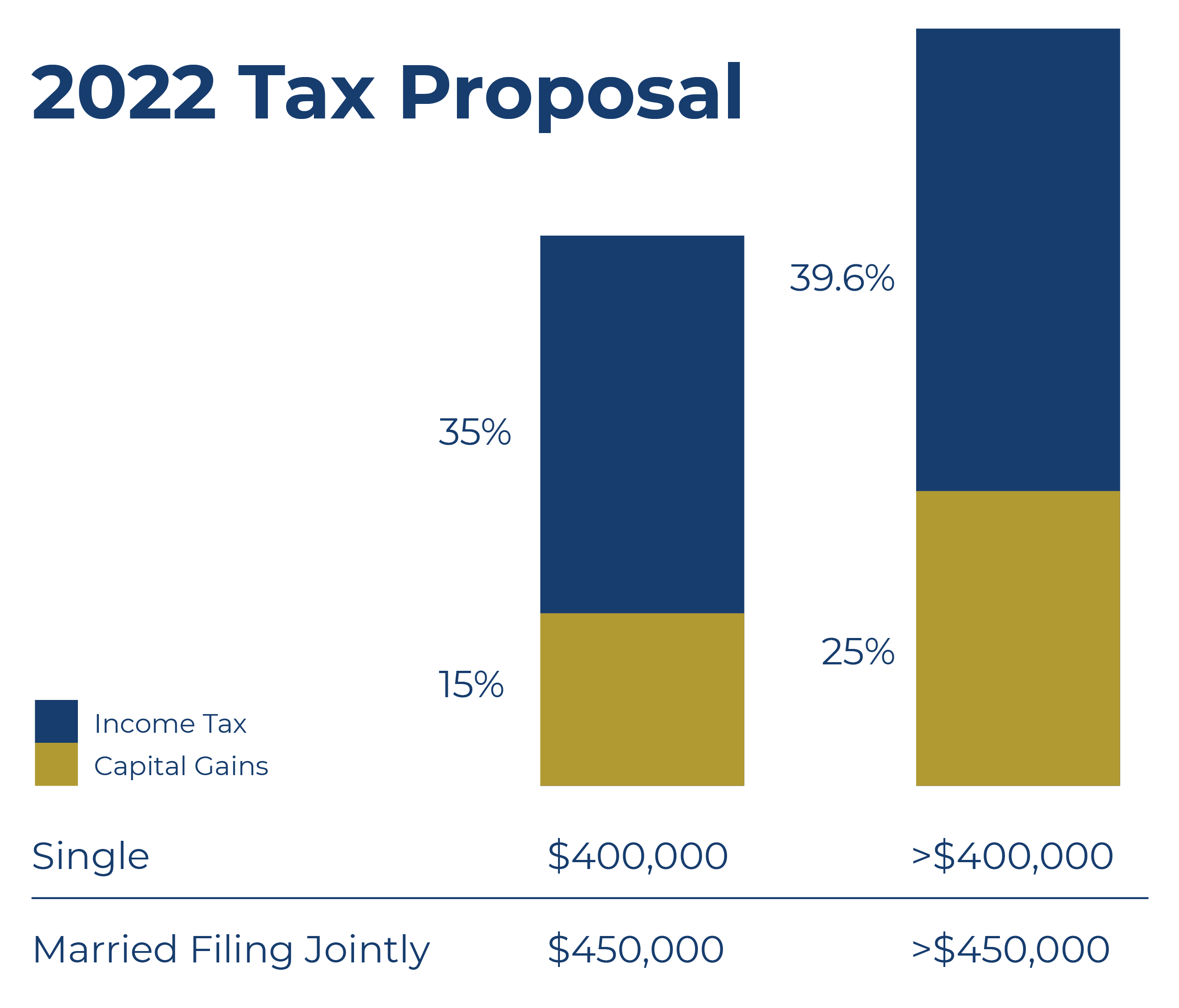

. My wife and I will have a taxable income. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. It would apply to single taxpayers with over 400000 of income and married.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to. The Presidents tax plan would raise the top ordinary tax rate from 37 to 396. Given what the president has proposed the wealthiest people in the US could see a significant hike in the capital gains tax rate.

By Naomi Jagoda - 072421 500 PM ET. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. The American Families Plan Fact Sheet Biden Administration General Explanation of the Administrations Fiscal Year 2022 Revenue Proposals US Dept of the Treasury BTAX OnPoint.

House Democrats proposed a top 25 federal tax rate on capital gains and dividends. The Problems With an Unrealized Capital Gains Tax. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons.

Short-term gains face a top rate of 434 percent including the 396 percent statutory rate plus the 38 percent investment income surtax and long-term gains defined as those with. What is the capital gains tax on long-term gains in 2022. Tax policy was a part of the 2016 presidential campaign as candidates proposed changes to the tax code that affect the capital gains tax.

It would apply to those with more than 1 million in annual income. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one.

Under current law such capital gains have a two-tiered structure. Part of a larger bill uncontroversially titled the American Families Plan Biden would raise taxes on the well off in a few different ways. President Donald Trump s main proposed change to.

Up to 15 cash back I plan to sell my cottage in New York State in 2018 and wish to avoid a tax on my capital gains profit of 200000. The proposal called the billionaires minimum income tax would require that taxpayers worth more than 100 million pay a minimum of 20 on their capital gains each. The tax hike would apply to households making more than 1.

It hasnt been noticed much but proposed changes to capital-gains taxes have good news for some of the highest-earning Americans and bad news for those earning. Democratic presidential candidate Hillary Clinton has proposed a change in the top capital gains tax rates. This rate hike will affect stocks bonds.

For taxpayers with income over 1 million Biden has proposed raising the top capital gains rate to 396 as.

Managing Tax Rate Uncertainty Russell Investments

Capital Gains Full Report Tax Policy Center

Senate Republicans Urge Biden Not To Move Forward On Capital Gains Tax Proposal Financial Regulation News

Wall Street On Tax Plan It Will Incentivize Selling This Year Bloomberg

Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union

How President Joe Biden S Capital Gains Tax Proposal May Impact Investors Youtube

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

American Families Plan Tax Proposal A I Financial Services

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

What Does Biden S Capital Gains Tax Proposal Mean To You Estate And Probate Legal Group

How Does Biden S Long Term Capital Gains Tax Proposal Work R Ask Politics

Joe Biden S Proposal To Double Capital Gains Tax Rate Shakes Financial Markets Economics Bitcoin News

House Capital Gains Tax Better For The Super Rich Than Biden Plan

Capital Gains Full Report Tax Policy Center

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Capital Gains And Capital Pains In The House Tax Proposal Wsj

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk